While rising Internet and smartphone access fuelled growth in Asia Pacific (APAC) in 2016, varied infrastructure development, digital payments adoption and regulations make for an uneven e-commerce landscape across the region. Phocuswright’s Asia Pacific Online Travel Overview Ninth Edition: Online Travel Agencies analyses the competitive dynamics throughout APAC, with insight into online travel agency (OTA) gross bookings and growth rates. The report takes a deep dive into the four major OTA trends in APAC.

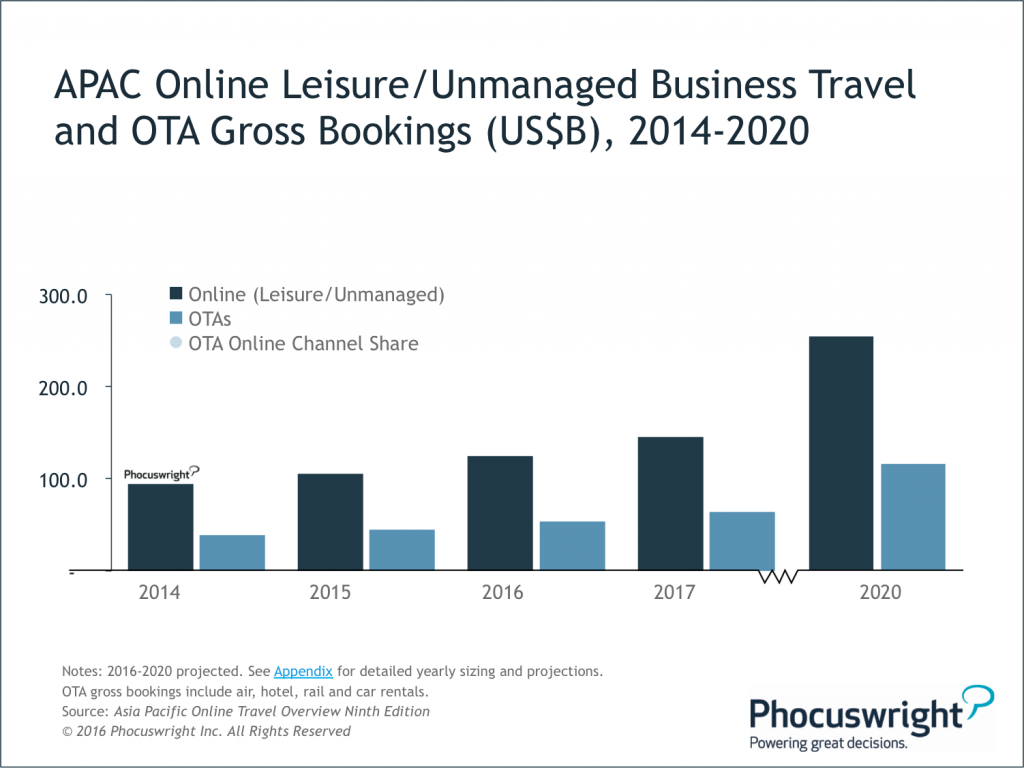

APAC is the world’s third-largest OTA region: Gross bookings hit US$44.5 billion in 2015, up 15% over 2014 and are forecasted to reach $96.5 billion by 2020.

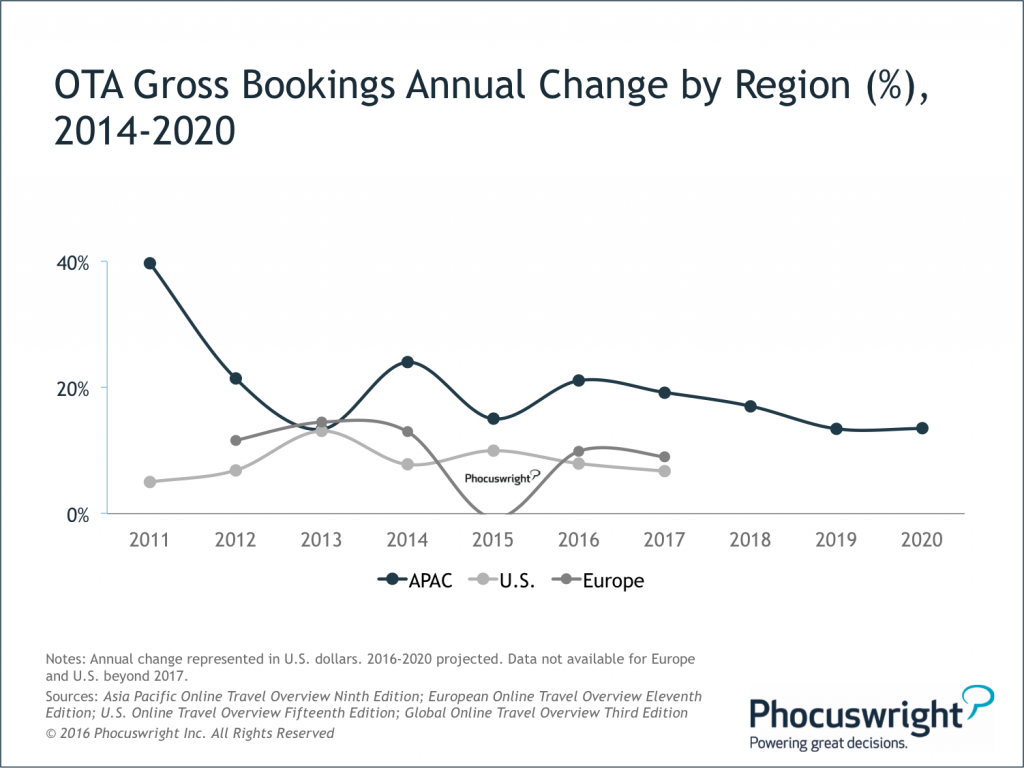

1- APAC Is the Fastest-Growing Major OTA Region Worldwide

Internet and smartphone penetration continue to rise, supporting travel bookings’ migration from offline to online channels in the region. With relatively underpenetrated online travel markets such as China, India and Southeast Asia fueling OTA growth, APAC OTA gross bookings grew 21% in 2016.

The supplier market structure also adds to OTA growth in the region. Broadly, the APAC air market is crowded and the hotel segment is highly fragmented, offering OTAs an advantage in aggregating and distributing varied content in one place.

2- Mobile Is the Norm

With ever-increasing smartphone penetration, APAC OTAs are allocating more resources toward mobile product development and marketing. Abetted by sales via apps, mobile share of OTA gross bookings in China hit 45% in 2015 – the highest in the world.

As technology companies, OTAs have a strong lead over suppliers across markets when it comes to mobile development and products. While suppliers largely focus on and distribute a single product/segment, most OTAs distribute an array of products within a single mobile platform, thus appealing more to consumers.

OTAs accounted for the majority of mobile gross bookings share in the region in 2016: India (86%), Japan (54%), China (52%).

Combined OTA mobile gross bookings for China, India and Japan were $14.7 billion in 2015, up 52% year-over-year. Continued discounting and price wars on mobile, however, dragged down transaction values (and put pressure on revenues) particularly in China and India, restraining OTA mobile gross bookings from growing at a faster rate.

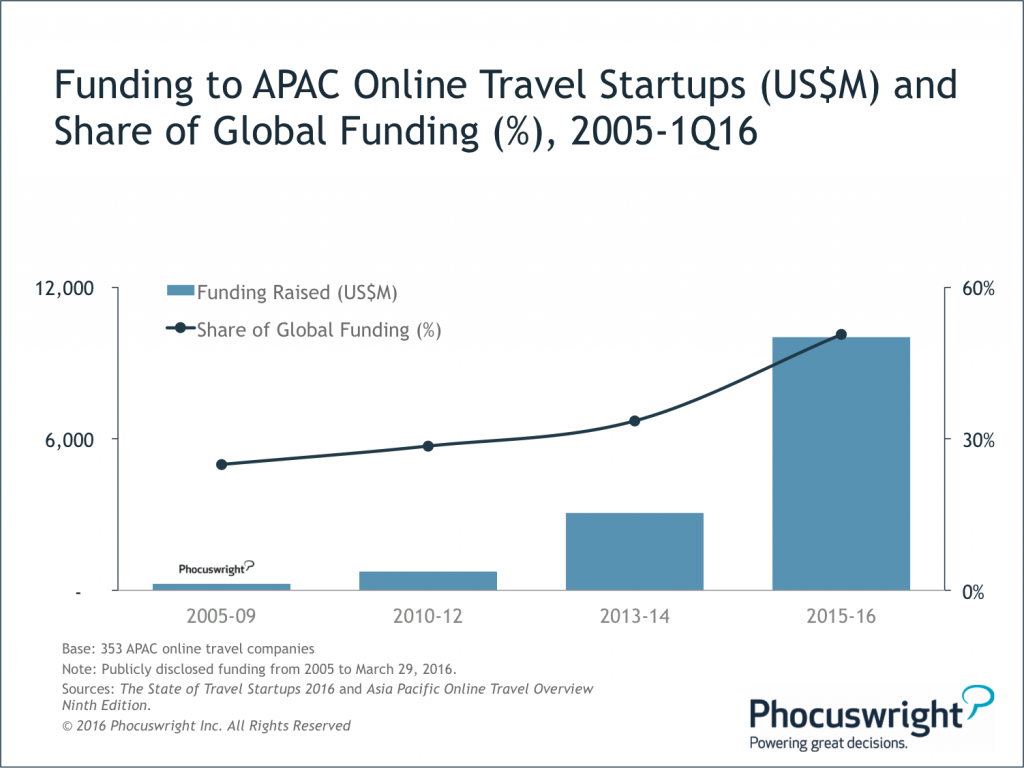

3- Online Travel Funding Swells, Competition Intensifies

Aggregate publicly disclosed funding to APAC digital travel startups exceeded $14 billion from 2005 through 1Q16, accounting for 43% of global funding. New entrants are challenging the established order and deploying capital toward price wars to win customer loyalty.

Funding to the region’s online travel companies has accelerated dramatically in the last decade; Chinese startups attracted 75% of the total regional funding.

Incumbent OTAs face competition – and a threat of displacement – from emerging intermediaries, which are tapping into new categories, attracting investor dollars and gaining consumer traction.

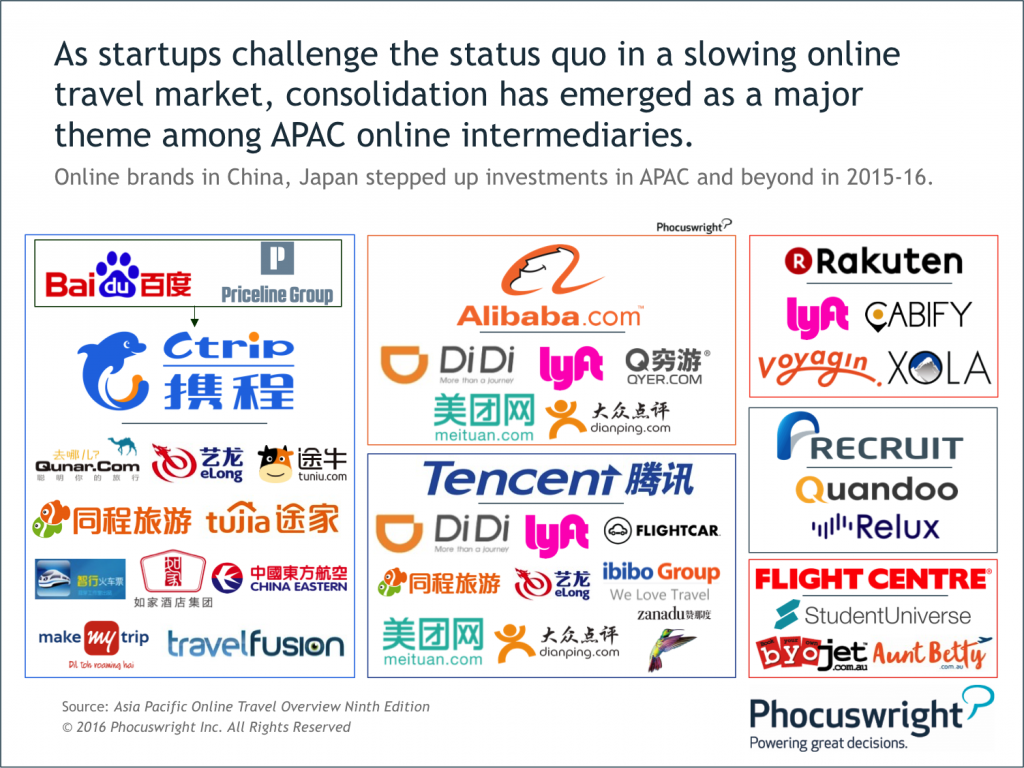

4- Consolidation Hits APAC Shores

As the region’s online travel industry matures and growth softens, major e-commerce players and OTAs have made notable investments and acquisitions to strengthen their positions in several markets.

As consolidation looms in the region, it’s eat or be eaten for APAC OTAs.

Want more information on OTA trends in the region? Get it straight from the leaders of APAC’s biggest OTAs at Phocuswright India (February 28 – March 2, 2017, in Gurgaon, NCR, India). This year’s program features several sessions with APAC’s leading OTAs including a Joint Interview of MakeMyTrip and ibibo Group, Keynote by Yatra.com and Joint Interview of Fliggy (Alitrip) and Paytm among others.

Phocuswright India provides an unmatched opportunity to meet, learn from and collaborate with Asia Pacific’s top decision makers. It brings together a good mix of speakers and attendees carrying wide experiences boosting the value for attendees. You can find details about all speakers here.

Register now to network and learn from Asia Pacific’s most innovative thinkers and leaders in the hospitality, travel and tourism industry.